ui federal tax refund

The amount of the refund will vary per person depending on overall income tax bracket and how much earnings came from unemployment benefits. Filed 74 and wondering how long this should take.

Report Unemployment Benefits Income On Your Tax Return

Workers can exclude the aid when calculating their modified.

. Using the IRS Wheres My Refund tool Viewing your IRS account information. If so any update on when it will be coming. As taxable income these payments must be reported.

The American Rescue Plan which President Joe Biden signed in mid-March waived federal tax on up to 10200 of unemployment benefits per person. The law waives federal income taxes on up to. The American Rescue Plan which was signed into law by President Joe Biden on March 11 made the first 10200 of unemployment income tax-free for people with adjusted.

Taxpayers should not have been. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally issued 430000 refunds on Monday to those who qualify for the. The IRS will start.

Whether you owe taxes or youre expecting a refund you can find out your tax returns status by. Youre eligible for the tax refund if your household earned less than 150000 last year regardless of filing status. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189 to filers who paid too much in taxes for their 2020 unemployment benefits.

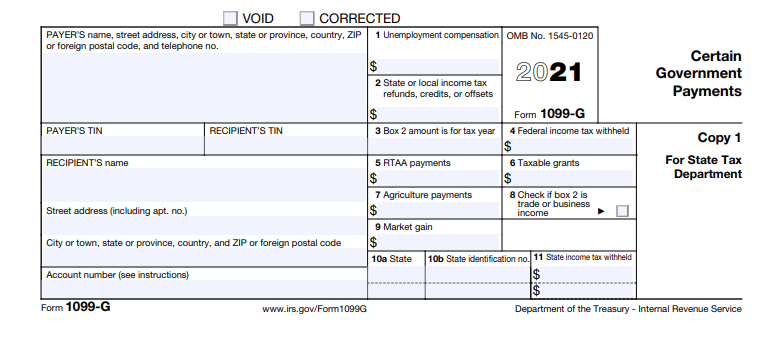

Tax Information Form 1099G Form 1099G reports the total taxable income we issue you in a calendar year and is reported to the IRS. So far the refunds have. The 19 trillion American Rescue Plan signed into law last week includes a welcome tax break for unemployed workers.

Anyone file an amended return this month or last month. The American Rescue Plan Act of 2021 excluded up to 10200 in unemployment compensation per taxpayer from taxable income paid in 2020.

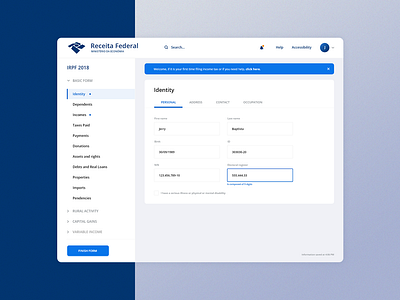

Find Irs Tax Forms Designs Themes Templates And Downloadable Graphic Elements On Dribbble

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Michigan Finally Releases Tax Forms For Those Who Were Jobless In 2021

Taxes Q A How Do I File If I Only Received Unemployment

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Accessing Your 1099 G Sc Department Of Employment And Workforce

California Edd 1099g Tax Document In The Mail California Unemployment Help Career Purgatory

1099 G Unemployment Compensation 1099g

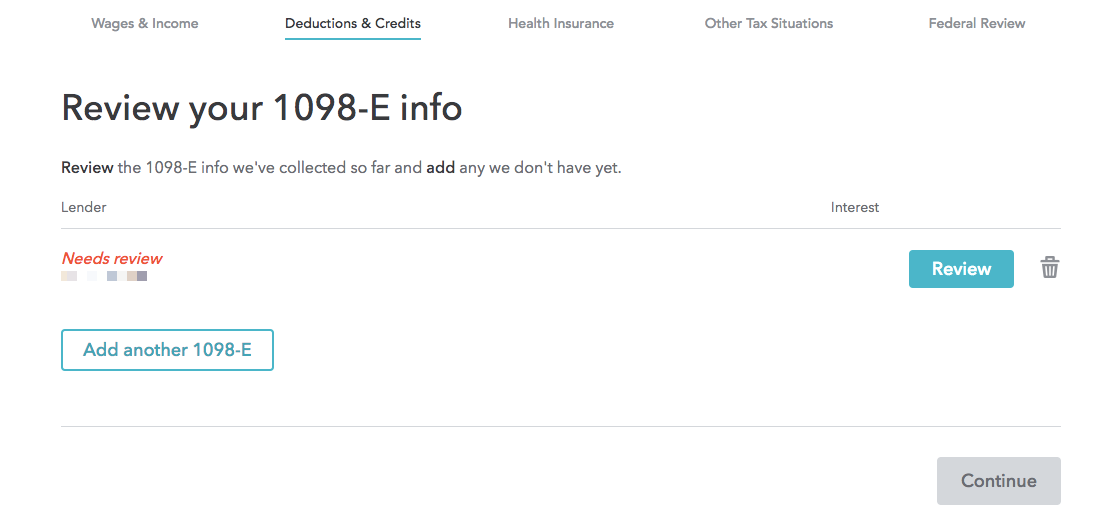

Why I Love Filing My Taxes A Ux Ui Analysis Of Turbotax By Emilia Totzeva Ux Collective

Are Unemployment Benefit Payments Taxable At A State And Federal Level 1099 G Forms How Much Do I Have To Pay Based On My Withholding Aving To Invest

When Will Proseries Update The New Unemployment Waiver Where 10 200 Of Unemployment Is No Longer Taxed By Federal Intuit Accountants Community

How Turbotax Turns A Dreadful User Experience Into A Delightful One Appcues Blog

Year End Tax Information Applicants Unemployment Insurance Minnesota

Is Ui Unemployment Insurance Taxable Taxation Portal

Covid 19 Coronavirus Tax Relief News Archives Optima Tax Relief

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

![]()

What To Know About Unemployment Refund Irs Payment Schedule More